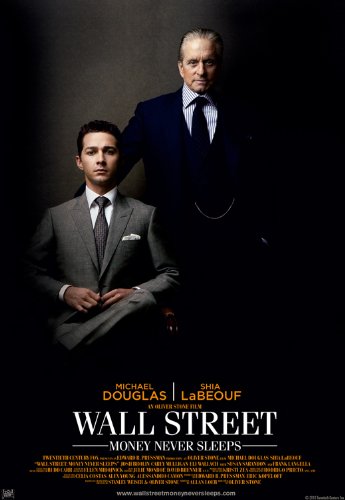

Wall Street 2: Money Never Sleeps [DVD]

Rating:

Twenty three years have passed since the original Wall Street introduced Gordon Gekko, the insider trader who insisted ‘Greed is good’ and ‘Lunch is for wimps’, and eventually receives a jail sentence. The film stood up on its own, almost defining a whole ‘Yuppie’ generation, so why bring out a sequel now?

My suspicions are that a sequel will do no harm to the careers of Michael Douglas (Gordon Gekko) or director Oliver Stone, and despite the long shadow of the parent film, ‘Money never sleeps’ is a worthy enough sequel to likewise stand alone.

Less obvious perhaps, but a serious message is also illustrated here. The current global financial crisis represents a perfect opportunity to explore the human element behind what is happening. Oliver Stone is saying that not only did we fail to learn the lessons of the stock market crash following October 19th 1987, but with an avalanche of toxic debt, economic stagnation, and the prospect of long term recession, the worst could be yet to come..

Having turned writer while in prison, with ‘Is Greed Good?’ Gekko lectures college undergraduates on basic economics. Arguably a high point of the film, I liked the image he portrayed of prison as time to reflect on sanity, and the contrast of the world viewed through the bars, a world going even madder ‘it’s ugly times ugly, and that’s when the ugly get going’, succinctly summarizing corporate greed.

In Wall Street, Gekko was greed. “You see that building? I bought that building ten years ago. My first real estate deal. Sold it two years later, made an $800,000 profit.. At the time I thought that was all the money in the world. Now it’s a day’s pay..” but here, he has taken on the role of a guru, someone who has seemingly experienced pain and redemption. What is greed, in any case? Is it an emotional response to the temptations caused by the ‘this is not enough’ syndrome? Or is it an all consuming desire for excess? Why does greed manifest itself prominently in some people, often (ironically) in those who ‘have it all’?

In this storyline at any rate, I would have liked more antagonism between Gekko and banker Bretton James (Josh Brolin) who didn’t convince as a villain, despite his painting of choice, the morbid ‘Saturn Devouring His Son’ by Goya. In the confrontation between them however, Gekko says, ‘I will do a trade with you. If you stop telling lies about me, I’ll stop telling the truth about you’, a great quote, but it wasn’t clear what the lies were. We like a villain, but Gekko was already in this role, and if the premise of the film was: is he reformed or is he not? the storyline became complicated here.

Other minor moans. I would have liked to see less slick shots of Manhattan. I know they are a trademark of Oliver Stone’s, but they took up too much time; the plot was interrupted. Secondly, the ending was weak. Somehow, Gekko got his hands on estranged daughter Winnie’s ( Carey Mulligan) $100m trust fund. Clearly, the crafty old lizard was not completely reformed. As portrayed, during her (presumably) nine month pregnancy, Gekko turned it into $1.1bn. He did so by buying British government financial assets at knockdown prices, that at least was feasible! He then returned the $100m to the pet fusion project of fiancé Jake Moore (Shia LaBoeuf) in a move of reconciliation. The money was clearly safer in the care of dad. Incidentally, the fusion project, ‘clean, green energy for nothing’, predicts a future for investment in reality more of a gamble than even here portrayed.

At the beginning of the film, Jake invests $1m of his own bonus on 50% margin into his bosses bank ‘Keller Zabel’ and keeps his position even as the stock is plummeting, putting him into $0.5 m debt. Firstly, firms usually prohibit employees on speculating on their own stock due to the possibility of having insider information and secondly, if Jake was such an excellent prop trader he wouldn’t have touched the stock if there were rumours of collapse.

Personally, I didn’t like the subplot with Jake’s mother (Susan Saradon) who seemed in the film to epitomise the property developer’s nightmare, a portfolio of properties without buyers, no capital to complete them, and rapidly diminishing values. Her son’s bailouts ensured she didn’t find more constructive solutions, but his lecturing just sounded priggish.

I would have liked to see more of old fashioned banker Louis Zabel (Frank Langella). He was under immense pressure, ‘they tell me they’re making money on losses, how do you make money on losses?’ His bank went the way of Lehman brothers, or in the same timescale as the film, Bear Sterns. At this point, real life was undoubtedly more exciting than fiction. The story is told in House of Cards: A Tale of Hubris and Wretched Excess on Wall Street, a 2009 finance novel written by William D. Cohan. It chronicles the history of Bear Sterns, from its founding in 1923 to its collapse and sale to JP Morgan in 2008, following the subprime mortgage crisis. It gives the reader an inside glance into the wild, larger than life personalities of Bear Sterns’ senior management: the rise of Bear Sterns from a third tier firm into the fifth largest investment firm in the U.S, the rise of Alan Greenberg, and his unsuccessful power struggle with James Cayne; the second power struggle between Warren J. Spector & Alan Schwartz; and the recklessness of the over leveraged hedge fund supervised by Richard A. Marin & Ralph R. Cioffi.

Why do I give ‘Money never sleeps’ five stars? For two reasons. Firstly, and without forgetting the rest of the cast, for putting Michael Douglas’s portrayal of Gordon Gekko back in the spotlight, older and wiser, ‘time is the most valuable commodity I know’, and secondly, for sounding a warning over a financial system out of control, government bailouts cushioning bad practice and distorting decision making, the speed at which financial markets can fall, and the folly of unsubstantiated stock growth, and lessons unlearnt. How big will the bubble get before it bursts? Again?

See also: The Corporation: The Pathological Pursuit of Profit and Power